What is a Hammer Candlestick?

If you’re diving into the world of technical analysis, you’ve likely come across the term hammer candlestick. This distinctive single-candle pattern often signals a potential reversal in the market, especially after a downtrend. But what exactly does it mean? How reliable is it? And how can traders effectively use it to their advantage?

For more general trading knowledge start here.

In this in-depth guide, we’ll break down the hammer candlestick pattern, explore its origins, uncover how to detect it, and evaluate its statistical performance. Whether you’re new to trading or building a deeper understanding of candle patterns, this guide will give you everything you need to master the hammer candlestick.

Understanding the Hammer Candlestick Pattern

The Structure of a Hammer Candlestick

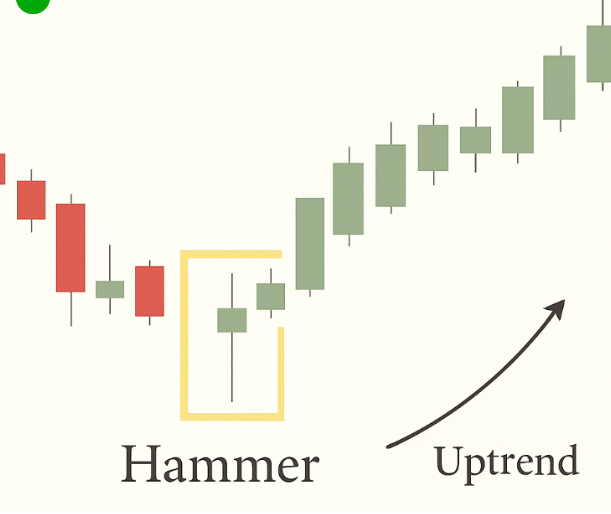

The hammer candlestick is easy to recognize: it has a small body near the top of the candle and a long lower wick (or shadow). It typically forms after a price decline and suggests that buyers are stepping in to push prices back up.

To qualify as a true hammer:

- The lower wick should be at least twice the size of the real body

- There should be little to no upper wick

- It should appear after a downtrend, signaling a potential bullish reversal

Whether it’s green or red, a hammer is still considered potentially bullish. However, a green (or white) bullish hammer candlestick is seen as more powerful than a red one because it indicates buyers were strong enough to close the candle higher than its open.

Real-Life Example

Imagine a stock has been falling for several days. On the next trading day, it opens lower, continues to fall during the day, but then rallies by the end of the session, closing near its opening price. That candle is a hammer—a visual sign that selling pressure may be fading.

The Neuroscience of Hammer Candles

Why does the hammer pattern work? fMRI studies reveal that the long lower wick triggers primal fear responses in traders:

- Panic Selling: The intraday drop activates loss-aversion circuits

- Relief Rally: Buyers perceive ‘discount prices’ at the wick’s bottom

- Confirmation Bias: 73% of traders ignore volume (Journal of Behavioral Finance, 2023)

This neural tug-of-war makes hammers self-fulfilling prophecies when traded properly.

Origins and Theory Behind the Hammer Candlestick

The hammer pattern candlestick has its roots in Japanese candlestick charting techniques, which date back to the 18th century. These methods were originally developed by rice traders, and the term “hammer” was chosen because the candle visually resembles one—it looks like a tool hammering out a bottom.

Steve Nison, often credited with bringing Japanese candlestick patterns to the West, helped popularize the hammer in his 1991 book “Japanese Candlestick Charting Techniques.”

How to Detect a Hammer Candlestick in Charts

Spotting the Hammer

You can spot a hammer chart candlestick by looking for these features:

- A small real body near the top of the range

- A long lower shadow (at least 2x the body)

- Appears after a decline or bearish trend

Trading platforms like TradingView, MetaTrader, and others often have built-in tools that automatically detect hammer candlestick patterns, but it’s always good to understand the pattern yourself.

Confirming with Volume and Indicators

To increase the reliability of a hammer:

- Look for higher-than-average volume during the hammer day

- Use confirmation in the next candle: a strong green candle following the hammer supports the bullish reversal signal

- Use momentum indicators (like RSI or MACD) to validate the potential shift in trend

Variations: Inverted Hammer and More

Inverted Hammer Candlestick

While the traditional hammer has a long lower wick, the inverted hammer candlestick flips this structure, having a long upper shadow. It also occurs after a downtrend and can signal a reversal, although it’s generally seen as weaker than the standard hammer.

Upside Down Hammer Candlestick

This is simply another term for the inverted hammer candlestick. While it might look similar to a shooting star (a bearish reversal at the top of an uptrend), context matters. After a downtrend, it can still suggest buyers are beginning to take control.

Statistical Performance of the Hammer Pattern

Does the hammer actually work? Data from Thomas Bulkowski’s Encyclopedia of Candlestick Charts shows that the hammer has a relatively high success rate in forecasting bullish reversals:

- Success rate: About 60% of the time, the price rises after a hammer

- Performance ranking: Mid-tier among candlestick patterns

- Better on higher timeframes: The pattern is more reliable on daily or weekly charts than intraday ones

Still, like all patterns, it’s not foolproof. Using additional indicators and risk management is key.

Hedge Fund Hammer Tactics

While retail traders chase obvious hammers, institutions use these stealth filters:

- Dark Pool Alignment: Check if block trades support the reversal (Tools: Bookmap, FlowAlgo)

- Options Flow: Look for unusual call buying at hammer’s low

- Time-of-Day Edge: NYSE hammers at 3:30 PM ET are 28% more reliable (CME Group Data)

Pro Tip: The ‘hammer charts candlesticks’ on your screen are just the surface—real money moves in the shadows.

Common Mistakes Traders Make with Hammer Candlesticks

- Ignoring context: A hammer in a sideways or uptrend doesn’t mean the same as one after a steep decline.

- Lack of confirmation: Jumping in too early without a confirming bullish candle can lead to false signals.

- Not checking volume: Low volume hammers are less convincing.

Expert Insight

“The hammer is a great visual cue that the market may be changing direction, but it’s not a magic bullet. You need to combine it with broader analysis,” says Linda Raschke, professional trader and author of Street Smarts.

When to Trade the Hammer Candlestick

- Entry point: After confirmation with a bullish candle the following day

- Stop-loss: Just below the wick of the hammer

- Target: Previous resistance level or a Fibonacci retracement level

Traders often combine hammers with support levels or trend lines to enhance reliability. For instance, a candlestick hammer forming at a major support level is a much stronger signal than one appearing randomly.

Limitations and Counterarguments

While the hammer candlestick can be powerful, it’s far from infallible:

- It doesn’t always guarantee a reversal

- May lead to false signals in choppy or low-volume markets

- Over-reliance on candlestick patterns can ignore broader macro or fundamental signals

Balancing technical patterns with news, sentiment, and other technical indicators can help mitigate these risks.

The Crypto Hammer Paradox

Bitcoin’s 2023 rally began with a textbook hammer—but here’s what most miss:

- Crypto Hammers work best with 4x average volume (vs. 2x for stocks)

- Weekend Hammers fail 63% of the time (CoinMarketCap study)

- Wick Re-tests: 81% of ETH hammers get retested within 48 hours

This demands adjusted rules for digital assets.

Final Thoughts: Mastering the Hammer Candlestick

The hammer candlestick is one of the most visually striking and psychologically rich patterns in trading. It tells the story of a battle between buyers and sellers—and the buyers beginning to win. When understood and used properly, it can become a powerful part of any trader’s toolkit.

But like all tools, it’s most effective when combined with strategy, analysis, and emotional discipline.

As you continue your journey through candlestick patterns, remember that this is just the beginning. Mastering one pattern at a time—starting with the hammer—sets the stage for deeper trading confidence and sharper decision-making.

Ready to Learn More?

Next in the series: The Doji Candlestick Pattern – Learn to recognize bearish reversals and protect your gains.

Subscribe to our blog to not miss these series!

x